How to Share Rent Receipts with Your Employer – RentOk

Ever wondered why your employer asks for rent receipts? Or why your parents always keep those slips safe? Well, it’s not just about keeping records! It’s actually a super important step to save money on taxes, thanks to something called HRA, or House Rent Allowance. If you’re living in a rented place, or even if your parents are, understanding HRA can help you save a good chunk of money.

In this blog post, we’ll break down everything you need to know about HRA, why rent receipts are so important, and how RentOk can be your best friend in this process. So, let’s dive in and learn how to make the most of your rent payments!

What is HRA and Why Does it Matter?

Let’s talk about HRA. It stands for House Rent Allowance. Think of it as a special part of your salary that your employer gives you to help with your house rent. The cool thing about HRA is that you can get a tax benefit on it. This means a part of your income that goes towards rent might not be taxed, which ultimately reduces the amount of tax you have to pay. Sounds good, right?

Now, why do employers need your rent receipts? It’s simple. To give you that tax benefit, your employer needs proof that you are actually paying rent. The government, through the Income Tax Department, wants to make sure that people are genuinely living in rented accommodation and paying rent to claim this allowance. Rent receipts are your official proof of these payments. Without them, your employer can’t process your HRA exemption, and you might end up paying more tax than you need to. So, keeping those rent receipts safe and submitting them on time is super important for your financial well-being.

The Traditional Way vs. The Smart Way (RentOk)

In the old days, getting rent receipts ready for your employer was a bit of a headache. Imagine this: you’d have to ask your landlord for a physical receipt every month, make sure they signed it, and then keep all those paper receipts safe. If you lost one, or if your landlord forgot to give you one, it could be a real problem when it came time to submit them to your employer. Then, you’d have to manually calculate everything, which could be confusing and lead to mistakes. It was a lot of paper, a lot of chasing, and a lot of stress.

But guess what? We live in a digital world now, and there’s a much smarter, easier way to handle all this is RentOk!

RentOk is a super handy online platform that takes all the hassle out of generating and managing your rent receipts. It’s designed to be simple and user-friendly, so you don’t have to worry about missing receipts, complicated calculations, or piles of paper. With RentOk, everything is digital, organized, and just a few clicks away. It’s the modern solution for a modern problem, making your life a whole lot easier when it comes to HRA.

Step-by-Step Guide: Sharing Rent Receipts with RentOk

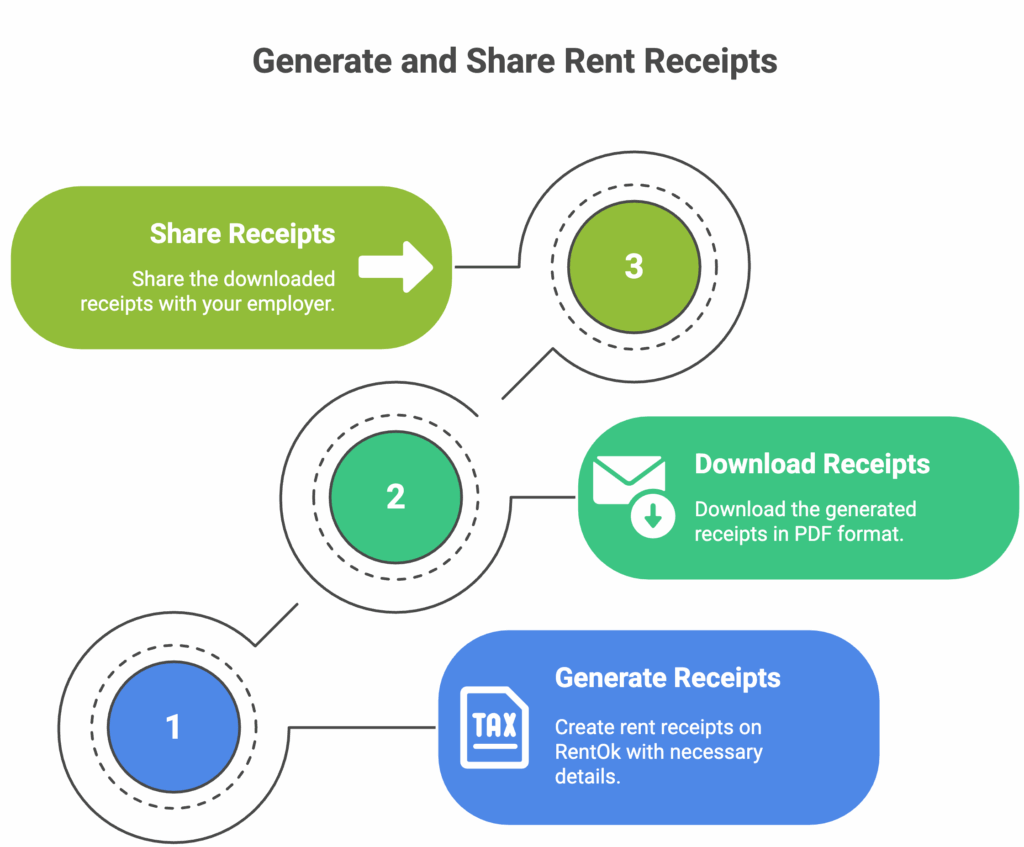

Now, let’s get to the exciting part: how to actually use RentOk to generate and share your rent receipts. It’s so easy, you’ll wonder why you ever did it the old way!

Step 1: Generate Your Rent Receipts on RentOk

First things first, you need to have your rent receipts generated on the RentOk platform. If your landlord is already using RentOk to collect rent, then this step is super simple – the receipts are probably already there! If not, you can easily create them. RentOk has a ‘Free Rent Receipt Generator’ tool on their website. You just need to enter some basic details like your name, your landlord’s name, the rent amount, the property address, and the period for which the rent is paid. Make sure all the information is accurate, especially the dates and amounts.

Step 2: Download or Share Your Receipts

Once your receipts are generated, RentOk allows you to download them instantly, usually in PDF format. This PDF is a professional-looking document that contains all the necessary details your employer will need. You can then easily share this PDF with your employer via email, or upload it to your company’s HR portal, depending on their process. No more physical papers to carry around or worry about losing!

What Information is on the RentOk Receipt?

A typical rent receipt generated by RentOk will include crucial information such as:

- Tenant’s Name: That’s you!

- Landlord’s Name: The person you pay rent to.

- Property Address: The address of the house or apartment you’re renting.

- Rent Amount: The exact amount of rent paid for a specific period.

- Payment Date: When the rent was paid.

- Receipt Number: A unique number for each receipt, making it easy to track.

- Landlord’s Signature: This is important for validation. RentOk helps in getting this digitally.

- Landlord’s PAN (Permanent Account Number): This is super important if your annual rent crosses a certain limit (we’ll talk more about this in the next section!).

Tips for Accurate Information:

- Double-Check Everything: Before you download or share, quickly review all the details on the receipt. A small mistake can cause delays in your HRA claim.

- Consistent Dates: Make sure the dates on your receipts match the period for which you are claiming HRA.

- Landlord’s PAN: If your annual rent is more than ₹1,00,000 (one lakh rupees), your employer will definitely ask for your landlord’s PAN card details. Make sure you have this information and it’s correctly entered on the receipt. If your landlord doesn’t have a PAN, they might need to provide a declaration.

Using RentOk for this step makes it so much simpler because the platform guides you through entering all the necessary details, reducing the chances of errors. It’s all about making your HRA claim smooth and stress-free!

RentOk Free Rent Receipt Generator: https://rentok.com/receipt-generator

Important Things to Remember (HRA Rules)

While RentOk makes generating receipts easy, there are some important rules about HRA that you should always keep in mind. These rules are set by the Income Tax Department in India, and following them correctly will ensure your HRA claim goes through without any problems.

1. Landlord’s PAN Card Requirement:

This is a big one! If the total rent you pay in a financial year is more than ₹1,00,000 (that’s one lakh rupees), then it’s mandatory to provide your landlord’s PAN (Permanent Account Number) details to your employer.

If your landlord doesn’t have a PAN, or refuses to share it, you might still be able to claim HRA, but you’ll need to get a declaration from them stating they don’t have a PAN. It’s always best to have the PAN if your rent is high, as it makes the process much smoother.

2. The Importance of a Rent Agreement:

While rent receipts are proof of payment, a rent agreement is proof that you are actually living in a rented property and have a legal agreement with your landlord.

Most employers will ask for a copy of your rent agreement along with your rent receipts. It’s a good idea to have a proper, stamped rent agreement in place. It protects both you and your landlord. If you’re wondering if you can claim HRA without a rent agreement.

We have an article on that too: Can HRA be Claimed Without a Rent Agreement?.

3. What if You Don’t Have Receipts?

Ideally, you should always have proper rent receipts. They are the primary proof. However, sometimes things happen – maybe you forgot to collect them, or your landlord didn’t provide them. If your monthly rent is very low (up to ₹3,000), you might be able to claim HRA without receipts.

But for higher amounts, it becomes very difficult and risky. The Income Tax Department can ask for proof, and if you don’t have it, your HRA claim might be rejected, and you could face penalties. So, always aim to get and keep your rent receipts.

4. Deadline for Submission to Employer:

Your employer will usually set a deadline for submitting your rent receipts (and other investment proofs) for HRA claims. This is typically towards the end of the financial year (around January to March).

Make sure you know this deadline and submit all your documents on time. Missing the deadline means you might not get the HRA benefit through your employer, and you’ll have to claim it directly when filing your income tax return, which can be a bit more complicated.

By keeping these points in mind, you can ensure that your HRA claim is successful and you get the tax benefits you deserve. RentOk helps you stay organized, making it easier to meet these requirements.

Benefits of Using RentOk for Rent Receipts

By now, you must have realized that RentOk is not just another app; it’s a game-changer when it comes to managing your rent receipts and claiming HRA. Let’s quickly sum up the amazing benefits it offers:

- Convenience and Ease of Use: No more chasing landlords for physical receipts or struggling with manual calculations. RentOk makes the entire process digital and incredibly simple. You can generate, download, and share receipts from anywhere, anytime, using your phone or computer.

- Accuracy and Professionalism: RentOk ensures that your rent receipts are accurate and professionally formatted. This reduces the chances of errors that could lead to issues with your HRA claim. The receipts are designed to meet all the requirements of the Income Tax Department.

- Digital Record Keeping: All your receipts are stored digitally on the RentOk platform. This means you’ll never lose a receipt again! You have a secure, organized record of all your rent payments, which is super helpful for tax purposes and general financial tracking.

- Time-Saving: Imagine the time you save by not having to manually fill out receipts, scan them, or physically deliver them. RentOk automates much of this process, freeing up your time for more important things.

- Transparency: With RentOk, there’s clear transparency in your rent payments. Both you and your landlord have a clear record, which can help avoid any misunderstandings.

In short, RentOk takes away the stress and complexity of managing rent receipts, making it a smooth and efficient process for everyone involved. It’s truly the smart way to handle your HRA claims.

Conclusion

So, there you have it! Sharing rent receipts with your employer for HRA claims doesn’t have to be a complicated or stressful task. With tools like RentOk, the entire process becomes incredibly simple, efficient, and accurate. By understanding what HRA is, why rent receipts are important, and how to use RentOk effectively, you can ensure you get the tax benefits you deserve.

Remember, staying organized with your rent payments and receipts is key to a smooth HRA claim. RentOk empowers you to do just that, making your financial life a little bit easier. So, if you haven’t already, give RentOk a try and experience the smart way to manage your rent receipts.

For more helpful tips and information on managing your property and finances, be sure to visit the RentOk blog!

FAQs

Here are some common questions people have about HRA and rent receipts:

Q1: Can I claim HRA if I live with my parents?

A1: Yes, you can! If you pay rent to your parents and they own the house, you can claim HRA. However, your parents must show this rent as income in their tax returns. It’s important to have a proper rent agreement with your parents and ensure the rent payments are made through bank transfers to have clear proof.

Q2: What if my landlord doesn’t have a PAN card?

A2: If your annual rent is more than ₹1,00,000 and your landlord doesn’t have a PAN card, you will need to submit a declaration from your landlord stating that they do not have a PAN. This declaration should include their name and address. However, it’s always better to have the PAN if possible.

Q3: How often do I need to submit receipts?

A3: Your employer will usually ask for rent receipts once a year, typically towards the end of the financial year (around January to March). However, some employers might ask for them quarterly or half-yearly. It’s best to check with your HR or accounts department for their specific policy.

Q4: What if my rent changes during the year?

A4: If your rent changes, make sure your rent receipts reflect the new amount from the month the change occurred. You should also update your rent agreement if the change is permanent. RentOk can help you generate receipts with varying amounts for different periods.